Everything About Offshore Investment: Insights Into Its Considerations and advantages

Offshore investment has become a progressively relevant subject for people seeking to diversify their portfolios and boost economic safety and security. While the prospective benefits-- such as tax optimization and property defense-- are engaging, they feature a complex landscape of dangers and regulative obstacles that call for careful factor to consider. Understanding both the advantages and the mistakes is crucial for any person contemplating this investment method. As we discover the nuances of offshore financial investment, it comes to be evident that notified decision-making is crucial for maximizing its possible benefits while minimizing inherent threats. What variables should one prioritize in this complex environment?

Comprehending Offshore Financial Investment

In the realm of international financing, understanding overseas investment is critical for individuals and entities seeking to maximize their financial portfolios. Offshore investment refers to the positioning of possessions in financial institutions outside one's country of house. This technique is frequently made use of to attain different monetary goals, including diversity, property security, and potential tax obligation benefits.

Offshore financial investments can encompass a broad selection of economic instruments, including supplies, bonds, mutual funds, and property. Financiers may choose to establish accounts in territories recognized for their positive regulative settings, personal privacy laws, and financial stability.

It is vital to identify that overseas investment is not naturally associated with tax obligation evasion or illegal tasks; rather, it offers genuine objectives for numerous capitalists. The motivations for involving in overseas financial investment can vary extensively-- from looking for higher returns in developed markets to guarding assets from political or economic instability in one's home nation.

Nonetheless, potential investors need to likewise understand the intricacies involved, such as compliance with international guidelines, the necessity of due persistance, and recognizing the lawful implications of offshore accounts. In general, a thorough understanding of offshore investment is important for making educated monetary decisions.

Trick Benefits of Offshore Investment

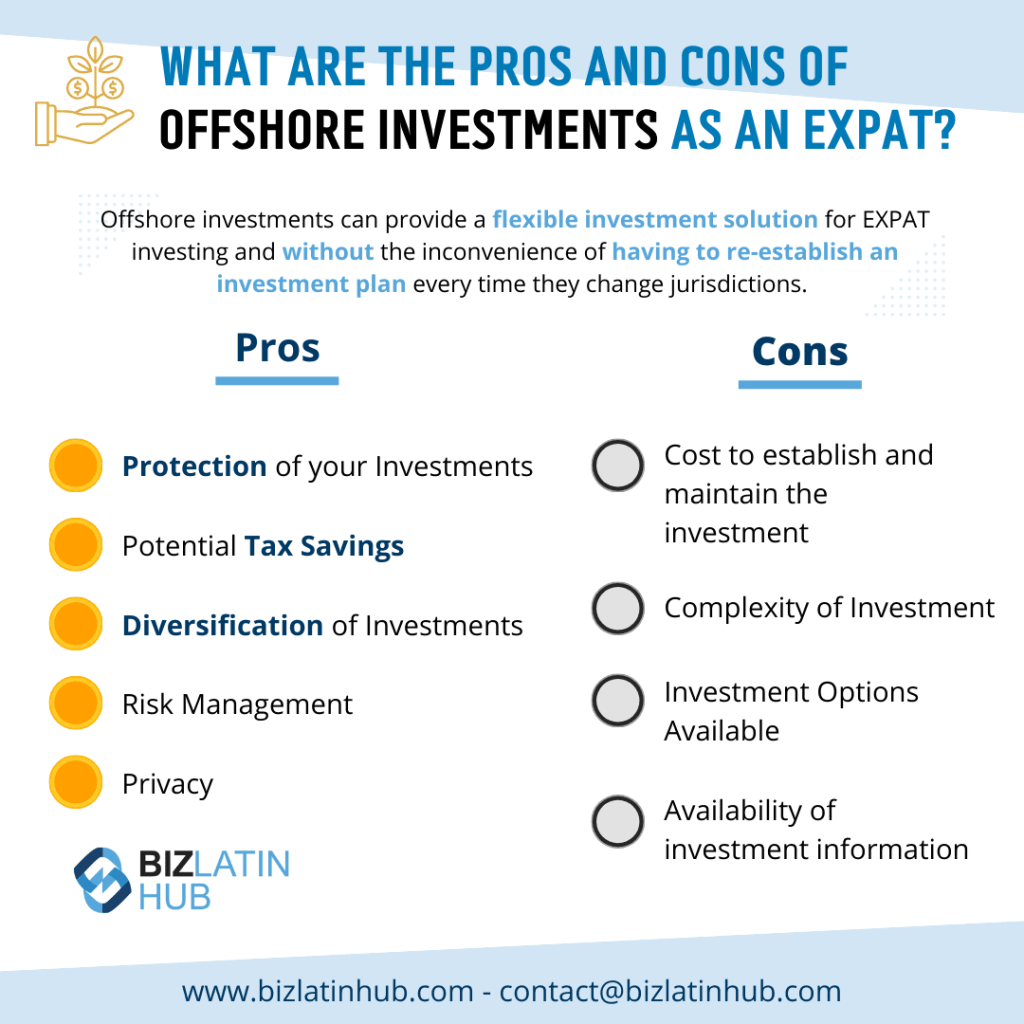

Offshore investment provides several essential benefits that can enhance an investor's financial strategy. One notable benefit is the possibility for tax obligation optimization. Lots of offshore jurisdictions offer positive tax obligation regimens, permitting capitalists to lessen their tax responsibilities legitimately. This can significantly raise total rois.

In addition, overseas financial investments usually supply access to a broader variety of financial investment possibilities. Financiers can diversify their profiles with possessions that may not be readily offered in their home nations, including global stocks, realty, and specialized funds. This diversification can decrease threat and improve returns.

Furthermore, overseas investments can facilitate estate planning. They allow capitalists to structure their assets in a manner that decreases estate taxes and makes sure a smoother transfer of wide range to heirs.

Typical Dangers and Challenges

Purchasing overseas markets can offer various risks and difficulties that require cautious factor to consider. One substantial threat is market volatility, as overseas investments may undergo fluctuations that can impact returns dramatically. Investors should additionally recognize geopolitical instability, which can interfere with markets and impact investment efficiency.

Another difficulty is currency risk. Offshore investments typically include transactions in foreign currencies, and unfavorable exchange rate movements can erode earnings or rise losses. Offshore Investment. In addition, minimal accessibility to trusted details regarding overseas markets can impede educated decision-making, resulting in potential missteps

Absence of governing oversight in some overseas jurisdictions can also pose hazards. Financiers might find themselves in environments where capitalist security is very little, increasing the danger of fraudulence or mismanagement. Varying financial techniques and social attitudes towards investment can complicate the financial investment process.

Lawful and Regulative Considerations

While browsing the complexities of overseas investments, understanding the governing and legal landscape is crucial for making sure and protecting properties compliance. Offshore financial investments are frequently based read this article on a multitude of regulations and policies, both in the capitalist's home country and the jurisdiction where the financial investment is made. It is crucial to conduct complete due persistance to comprehend the tax ramifications, reporting needs, and any legal responsibilities that might develop.

Governing structures can vary substantially between jurisdictions, influencing every little thing from taxes to funding requirements for foreign capitalists. Some countries might provide favorable tax obligation regimes, while others enforce stringent laws that could prevent financial investment. In addition, international agreements, such as FATCA (Foreign Account Tax Conformity Act), might obligate financiers to report overseas holdings, boosting the demand for transparency.

Capitalists have to additionally understand anti-money laundering (AML) and know-your-customer (KYC) regulations, which require banks to verify the identity of their customers. Non-compliance can cause extreme fines, including fines and limitations on investment activities. Engaging with lawful specialists specializing in worldwide investment regulation is essential to browse this complex landscape successfully.

Making Informed Choices

A critical method is essential for making notified decisions you could try this out in the world of overseas financial investments. Understanding the intricacies involved calls for extensive study and evaluation of numerous aspects, consisting of market patterns, tax obligation implications, and legal frameworks. Financiers must examine their risk tolerance and financial investment goals, making sure alignment with the special characteristics of offshore possibilities.

Scrutinizing the regulatory atmosphere in the selected jurisdiction is important, as it can dramatically influence the safety and profitability of financial investments. In addition, remaining abreast of geopolitical advancements and financial problems can give useful insights that educate investment strategies.

Involving with experts that concentrate on overseas investments can also enhance decision-making. Offshore Investment. Their expertise can direct investors through the intricacies of global markets, assisting to identify lucrative possibilities and prospective mistakes

Eventually, notified decision-making in offshore financial investments pivots on a well-rounded understanding of the landscape, a clear expression of specific purposes, and a commitment to ongoing education and learning and adaptation in a dynamic international setting.

Final Thought

In final thought, offshore financial investment presents substantial advantages such as tax optimization, asset defense, and access to international markets. It is necessary to recognize the connected risks, consisting of market volatility and regulatory difficulties. An extensive his response understanding of the legal landscape and diligent research study is essential for effective navigating of this complex field. By dealing with these considerations, financiers can properly harness the benefits of offshore financial investments while mitigating possible disadvantages, eventually leading to informed and calculated economic decisions.

Offshore financial investment supplies numerous vital advantages that can improve a capitalist's monetary method.In addition, overseas financial investments commonly offer accessibility to a broader range of investment possibilities. Varying economic methods and cultural perspectives toward investment can complicate the investment procedure.